The $340 million investment in the Molybdenum Autoclave Process (MAP) facility in Magna, Utah might seem like a strange move for a company that is so keen on divesting assets outside of copper, iron ore and aluminum. Take a closer look at the situation in Utah and it makes sense;

Despite a 5.4% increase in Mb output from Kennecott's operations in 2011 production still has yet to recover to 2007 levels. Ore grades are at low levels there so the facility is necessary;

The facility makes processing of ore more efficient, improves molybdenum recovery and enables higher grade metallurgical products to be produced.

Update: In early March 2012 Rio Tinto (world's 3rd largest mining company) announced an investment of $2 billion in an iron-ore project in the state of Orissa, India. Rio's goal there is to produce 15M tonnes/yr. If granted by the state, Rio will end up with 51% share in the project compared to 44% for Orissa Mining Company and NMDC 5%.

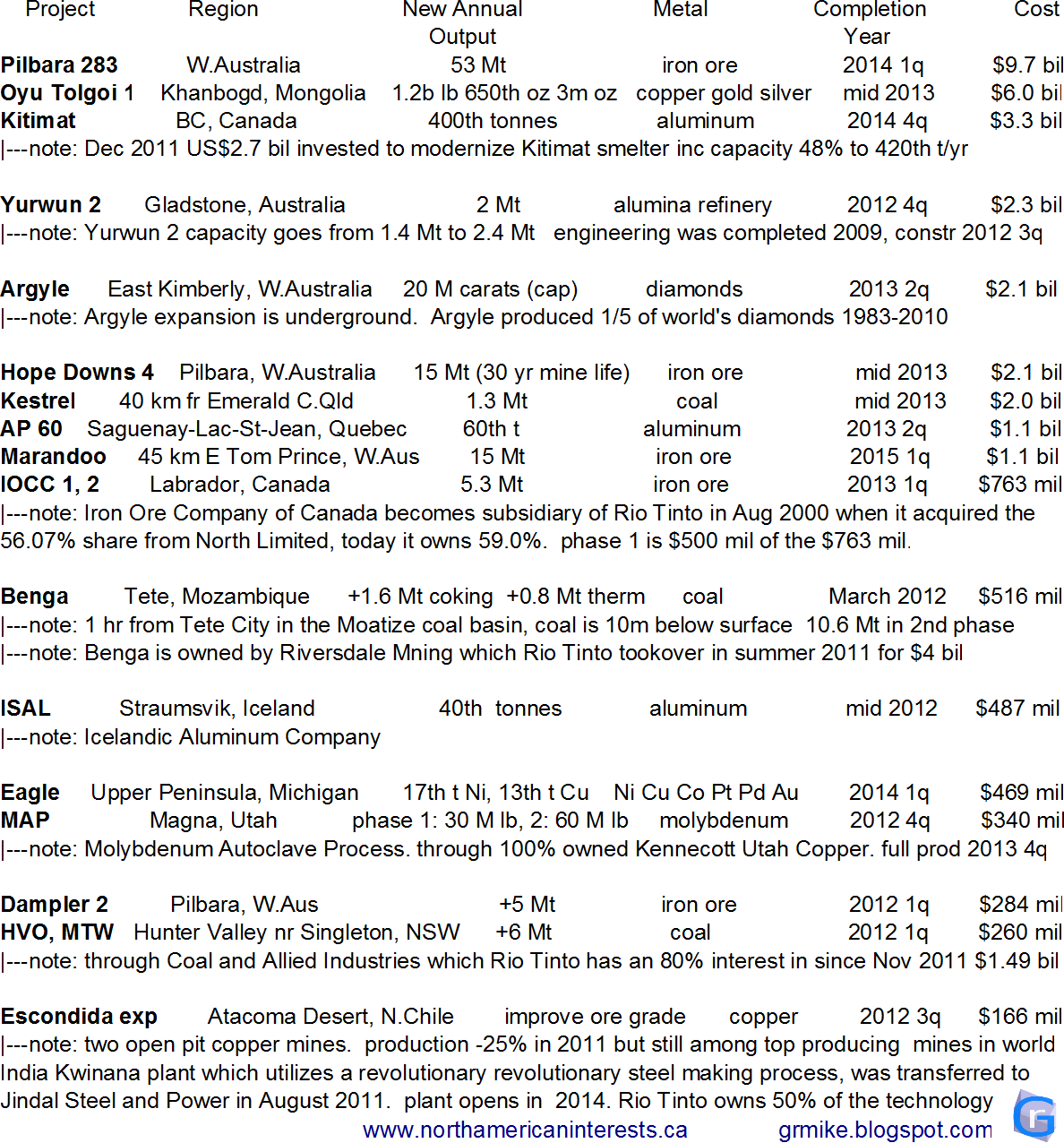

The operations listed to the left represent all of Rio Tinto's major projects underway (2012-2015). The sum of their capex spending exceeds $30 billion. Rio Tinto has raised $11 billion from asset sales since 2008 which is helping to fuel the current spending spree.

Rio Tinto's production by metal by year (2007-2011) & my summary of 2011 fiscal results can be found here.

Note: Subsidiary Kennecott Utah's Bingham Canyan mine produces between 15-18% of US refined copper.